Securing life insurance can be a crucial step in financial planning, and health plays a significant role in the underwriting process. Insurers closely examine an individual’s height and weight to assess their overall health and potential mortality risk.

I will guide you through how life insurance companies use body metrics to determine policy eligibility and premium rates. Understanding these factors can help you better prepare for the application process and potentially secure more favorable rates.

Key Takeaways

- How height and weight measurements impact life insurance eligibility and premium rates.

- The significance of body metrics in the insurance underwriting process.

- How insurers view height and weight as indicators of overall health.

- The importance of understanding these factors for a smoother application process.

- The role of BMI in determining life insurance rates.

How Height and Weight Impact Your Life Insurance Rates

Your build, which is determined by your height and weight, is a key consideration for insurers when calculating life insurance premiums. Life insurance companies analyze various factors to determine an individual’s risk profile, and height and weight are among the most critical metrics.

Insurers use height and weight to evaluate an applicant’s overall health and potential risk. The relationship between these two metrics is often used to calculate the Body Mass Index (BMI), which serves as an indicator of whether a person’s weight is in a healthy range for their height.

The Importance of Body Metrics in Underwriting

Body metrics, including height and weight, are crucial in the underwriting process because they help insurers predict potential health issues. An individual’s BMI and weight distribution can indicate their risk of developing conditions such as heart disease or diabetes, which could impact their life expectancy.

For instance, a person with a high BMI may be considered at higher risk due to the potential for obesity-related health issues. Conversely, someone with a very low BMI might also be viewed as a risk due to potential health complications associated with being underweight.

Why Insurers Care About Your Build

Insurers care about your build because it provides insight into your overall health and potential longevity. The distribution of weight, particularly around the abdomen, is a significant factor due to its association with increased risk of heart disease and other serious health conditions.

“The use of height and weight charts allows insurers to standardize their assessment of risk across different applicants, ensuring a fair and balanced evaluation process.”

Understanding how height and weight impact life insurance rates can help you better navigate the application process. By knowing how insurers view your build, you can take steps to potentially improve your rate classification.

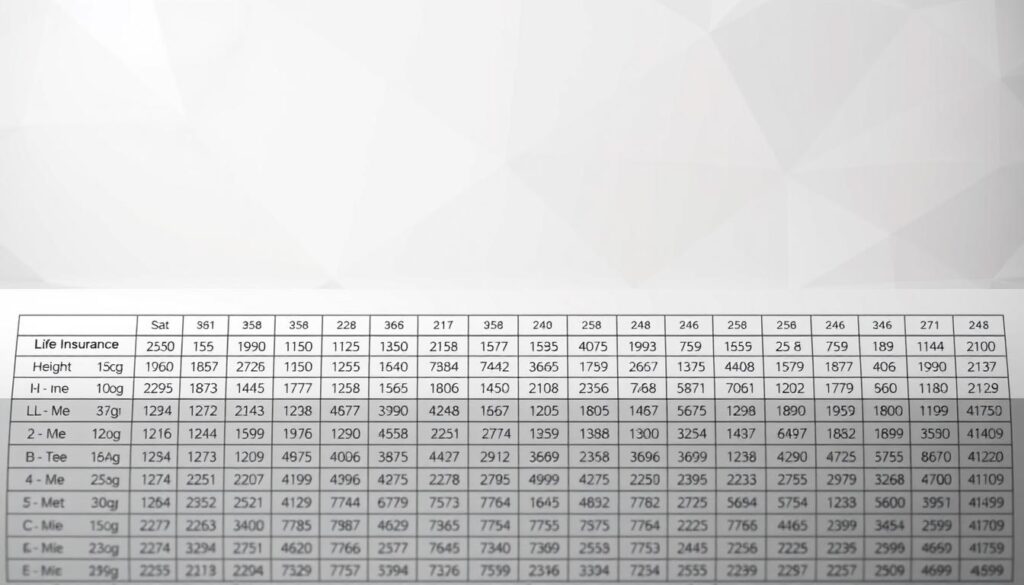

| Height (inches) | Weight (lbs) | BMI | Risk Category |

|---|---|---|---|

| 68 | 150 | 22.8 | Low Risk |

| 72 | 200 | 27.1 | Moderate Risk |

| 65 | 120 | 20.0 | Low Risk |

Understanding BMI and Its Role in Life Insurance

BMI plays a significant role in life insurance underwriting, as it helps insurers assess health risks associated with an individual’s weight and height. This measurement is crucial because it provides a quick and straightforward way to categorize applicants into different risk classes.

What Is BMI and How Is It Calculated?

Body Mass Index (BMI) is calculated by dividing an individual’s weight in kilograms by their height in meters squared. For instance, if you weigh 70 kilograms and are 1.75 meters tall, your BMI would be 22.9. This simple calculation gives insurers a baseline to evaluate whether your weight is in a healthy range for your height.

BMI Categories and Their Impact on Risk Assessment

BMI categories are used to assess health risks. A BMI between 20 and 25 is generally considered normal and is associated with lower life insurance premiums. Scores between 25 and 30 indicate an overweight build, potentially leading to higher premiums due to increased health risks. A BMI over 30 signifies obesity, which can significantly raise premium costs or even result in declined applications. Conversely, a BMI under 17 is considered underweight, also posing health risks.

Insurers use these categories to quickly assess risk, though they also consider other health metrics to get a comprehensive view of an applicant’s health.

Life Insurance Height Weight Chart Explained

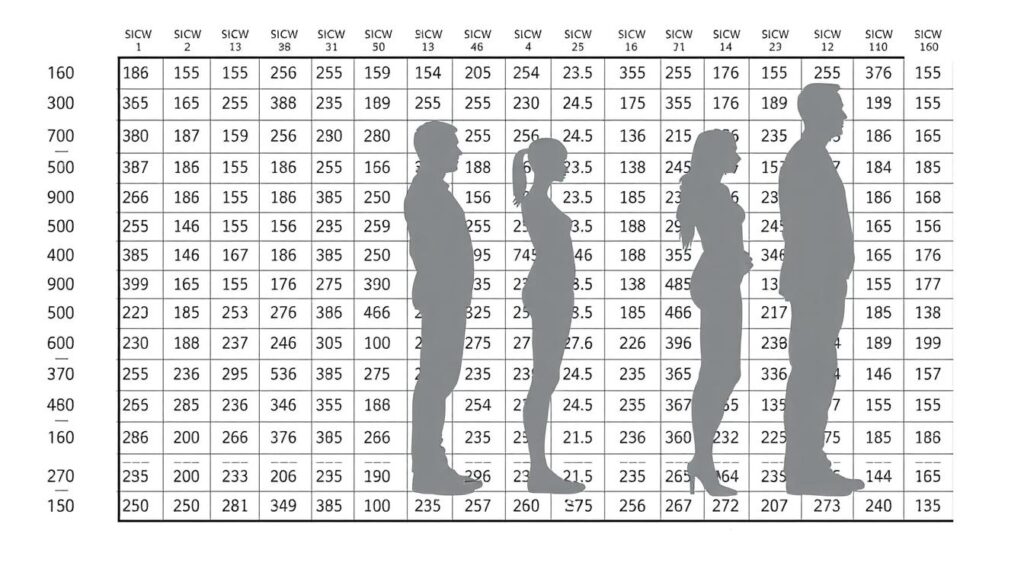

Understanding how life insurance companies use height and weight charts is crucial for determining your insurance premiums. Life insurance height weight charts are essentially matrices that correlate body metrics with risk categories, ranging from Preferred Plus to Standard and below.

To understand your standing, you need to find your height on the chart, track it to your weight, and identify your risk category. This category directly impacts your premium: the lower your risk, the less costly your insurance.

How to Read and Interpret Height Weight Charts

Reading a height weight chart is straightforward. First, locate your height on the chart, usually listed in inches or centimeters. Then, move across the chart to your weight, which is typically listed in pounds or kilograms. The intersection of your height and weight will indicate your risk classification, such as Preferred Plus, Preferred, or Standard.

Different insurance companies may have slightly different charts and classifications, so it’s essential to understand the specific chart used by your insurer.

Different Rating Classifications

Common rating classifications include Preferred Plus, Preferred Tobacco, Preferred Non-Tobacco, Standard Tobacco, and Standard Non-Tobacco. Each classification has its own set of criteria, including minimum and maximum weight limits for each height.

The Preferred Plus classification typically offers the lowest premiums, as it represents the lowest risk category. Understanding these classifications and how they impact your premium rates is vital when applying for life insurance.

How Insurers Use Height and Weight to Determine Risk

The relationship between height, weight, and life insurance rates is complex, involving various underwriting considerations. Insurers use a multifaceted approach to assess an applicant’s risk profile.

The Underwriting Process

The underwriting process is crucial in determining how height and weight impact life insurance rates. Underwriters evaluate applicants based on their height-weight ratio, assigning mortality ratings accordingly. For instance, builds associated with 150-350% higher mortality risk than standard are rated accordingly. This process involves assessing the applicant’s overall health and risk factors.

Underwriters consider various factors, including the applicant’s weight and height, to determine their risk classification. This classification directly affects the life insurance premiums.

Beyond BMI: Other Physical Factors Insurers Consider

While BMI is a significant factor, insurers also consider other physical attributes, such as waist circumference, body fat percentage, and weight distribution patterns. These factors provide a more comprehensive understanding of an applicant’s health and risk profile. For example, an applicant with a high BMI but a low body fat percentage may be viewed more favorably than one with a high BMI and high body fat percentage.

Insurers also consider the combination of height and weight with other health conditions, such as high blood pressure or diabetes, when determining the final risk classification. This holistic approach enables insurers to make more informed decisions about an applicant’s risk profile.

Real Examples of Premium Variations Based on Height and Weight

Height and weight play a substantial role in determining life insurance premiums, as demonstrated by real-world case studies. For instance, consider an individual who is 5’9″ tall. At 160 pounds, they may qualify for the preferred best category and enjoy lower premiums. However, at 220 pounds, the same individual might be categorized as standard, resulting in higher costs.

Case Study: Premium Differences for Various Builds

A closer look at premium differences for various builds reveals significant variations. For example, a 5’9″ individual weighing 160 pounds might pay $500 annually for life insurance, while the same person at 220 pounds could pay $800 or more. These differences underscore the importance of weight management in reducing life insurance costs.

Why Different Insurers Have Different Standards

Insurance companies develop their own proprietary height-weight charts, leading to different assessments for the same individual. This is because each company has its own historical claims data and actuarial experience. As a result, some insurers may offer more competitive rates for certain build profiles that others might rate more strictly. This variability means that shopping around is crucial to finding the best rates based on one’s height and weight.

Tips for Preparing for Your Life Insurance Medical Exam

A life insurance medical exam is a crucial step in determining your insurance premiums, and being prepared is key to a successful experience. Some life insurance products require a comprehensive medical exam to assess the applicant’s health and risk factors.

Pre-Exam Strategies to Improve Your Metrics

To optimize your height and weight measurements, it’s wise to be well-hydrated, abstain from alcohol, and be well-rested before the exam. Scheduling the exam for the morning and avoiding heavy meals can also influence your metrics. Reducing salt intake to limit water retention and maintaining a calm demeanor can help keep your blood pressure readings in check.

What to Expect During the Height and Weight Assessment

During the medical exam, your height and weight will be measured using standard equipment. The examiner will follow a specific protocol to ensure accurate readings. It’s essential to be aware that examiners may look for signs of attempted weight manipulation. Being truthful and prepared is crucial.

By understanding the process and preparing accordingly, you can ensure a smooth experience and potentially improve your insurance premiums. Some life insurance products even offer no-exam options, which may be suitable for those concerned about height-weight measurements.

Options for Those Outside “Ideal” Weight Ranges

Not fitting the ‘ideal’ weight range for your height doesn’t automatically disqualify you from obtaining life insurance. Adults whose build falls within the borderline zone may be accepted standard or rated, depending on their overall risk profile. This means that even if you’re outside the standard height-weight guidelines, you still have various life insurance possibilities to explore.

Insurance Possibilities for Overweight Applicants

For individuals who are considered overweight according to height-weight charts, there are still life insurance options available. Specialized insurance providers may offer more flexible underwriting guidelines for those with non-standard builds. Additionally, alternatives such as graded benefit policies, guaranteed issue coverage, and simplified issue products can provide coverage when standard policies are unavailable due to weight concerns.

Solutions for Underweight Individuals

Underweight applicants often face underwriting challenges that receive less attention than overweight issues. Working with an independent agent who has access to multiple carriers can help identify companies with more favorable height-weight guidelines for your specific build. Furthermore, group life insurance through employers often has more lenient height-weight requirements than individual policies, providing another potential avenue for coverage.

Conclusion: Making Informed Decisions About Life Insurance

Knowing where you stand in terms of height and weight can significantly influence your life insurance search. By understanding how these metrics impact your rates, you can make more informed decisions.

It’s essential to work with a knowledgeable insurance agent who can help navigate the complexities of height-weight guidelines across different insurance companies. Comparing policies from multiple life insurance companies is also crucial, as height-weight standards vary significantly between insurers.

Understanding your position on the height weight chart can help you set realistic expectations about premiums and available options. Small improvements in health metrics over time might qualify you for better rates through policy reconsideration in future years.

Remember, height and weight are just two factors among many that determine life insurance premiums and eligibility. Balancing premium costs with coverage needs is vital when height-weight factors affect your insurance options.

As life insurance products continue to evolve, some newer offerings place less emphasis on traditional height-weight measurements. I encourage you to seek coverage that meets your specific insurance needs regardless of where you fall on the height-weight spectrum.

FAQ

How do insurers use my body metrics to determine my premiums?

Insurers use my height and weight to assess my overall health risk and determine my premiums. They consider my body mass index (BMI) and other physical factors to evaluate my risk profile.

What is the ideal weight range for life insurance purposes?

The ideal weight range varies among insurers, but generally, it falls within a certain percentage of the standard weight for my height. Insurers use height and weight charts to determine this range.

Can being underweight affect my life insurance rates?

Yes, being underweight can impact my rates. Insurers view being underweight as a potential health risk, just like being overweight. My underwriting will consider my overall health and other factors.

How can I improve my chances of getting a better rate if I’m outside the ideal weight range?

I can take steps to improve my overall health, such as losing or gaining weight, exercising regularly, and managing any health conditions. This can help me qualify for better rates.

Do different insurers have different standards for height and weight?

Yes, different insurers have varying underwriting guidelines and weight limits. Some may be more lenient than others, so it’s essential to shop around and compare rates.

What other factors do insurers consider besides height and weight?

Insurers also consider other physical factors, such as blood pressure, medical history, and family medical history, to assess my overall health risk.

How can I prepare for my life insurance medical exam to get the best rate?

To prepare, I can follow a healthy diet, exercise regularly, get enough sleep, and manage any health conditions. This will help me achieve my best possible metrics and potentially qualify for a better rate.